Guilderland school tax rates higher than predicted outside of Guilderland

GUILDERLAND — The tax rates for the 2023-24 school year adopted by the school board on Aug. 15 turned out to be based on an error, said Assistant Superintendent for Business Andrew Van Alstyne on Aug. 17. The board will adopt new tax rates next week, he said.

The school board had set the rates higher than the estimated 2.66-percent increase predicted when voters went to the polls in May to pass a $120 million budget for this school year.

“The tax rates themselves are a process of math,” Van Alstyne told the board at its televised Aug. 15 meeting.

The lion’s share of the school district is in the town of Guilderland where the tax-rate increase “will be close to what was initially projected when the budget was adopted,” Van Alstyne told The Enterprise on Thursday, Aug. 17.

This is a change from the 6.01-percent increase the school board was informed of at its Aug. 15 meeting.

Van Alstyne said a board meeting is being scheduled for next week where the new numbers will be revealed; he said he could not divulge the new tax rates until the board adopts them.

Small portions of the district lie in three towns besides Guilderland: Bethlehem, which was to see a 13.55-percent jump in school taxes; New Scotland, which the board heard would get 8.39 percent increase; and Knox, with an increase that was to be 6.64 percent.

While Guilderland will be close to the 2.66 projection made last spring, Van Alstyne said on Aug. 17, “The rates for the other towns will be higher than the previous projection, because of their increased share of the levy. However, this increase will be significantly less than what was presented on Tuesday.”

Before disclosing the rate hikes to the board on Tuesday, Aug. 15, Van Alstyne displayed charts and graphs to show how the numbers were arrived at. He told The Enterprise on Thursday that these “larger trends are still the same.”

The first graph showed how, since 2017, the district has kept the levy change in line with inflation until last year when inflation went from the usual 1 to 3 percent, skyrocketing to 8 percent this year.

“In the last two years, inflation spiked,” said Van Alstyne, saying the district is experiencing that spike in the same way that “our residents are experiencing that impact in their lives.”

He added, “We’ve worked to keep the levy at a growth rate well below inflation.”

His chart showed Guilderland’s levy change for the 2022-23 school year at close to 3 percent while inflation was at close to 5 percent.

For the 2023-24 school year, with inflation at 8 percent, the district’s levy change is at 2.66 percent.

Van Alstyne went on to explain that each of the four towns, like towns across the state, assess differently so the state applies an equalization rate so that similar properties are paying equivalent taxes.

“Often, the further you are out from the time that evaluation was done, the more change or swing there can be in the equalization rate,” said Van Alstyne.

Guilderland, which last went through town-wide revaluation four years ago, has an equalization rate of 85 percent and has property in the district valued at $4.5 billion. Bethlehem, which last revalued nine years ago, has an equalization rate of 75 percent and has property in the district valued at about $360 million.

Much smaller portions of the Guilderland school district lie in New Scotland, about $21 million worth, and in Knox, about $37 million worth of property. New Scotland last revalued 17 years ago and has an equalization rate of 74 percent while Knox hasn’t revalued since 1997, which was 26 years ago, and has a state-set equalization rate of 39 percent.

The state releases municipal equalization rates after school budgets are voted on, Van Alstyne said, so districts don’t have those numbers to make tax-rate predictions for residents ahead of the state-set May voting date.

“So we carry over the existing numbers and project tax rates,” he said.

Van Alstyne went on, “Two factors really control the swing of the tax rate for a given levy.”

The first is the town’s share of the overall property value in the district and the second is the taxable valuation.

In the past two years in Guilderland, because of tax certiorari cases — where property owners have successfully challenged their assessments — Guilderland has seen “much more significant declines in assessed property value, that is, the amount of value the property is distributed across,” said Van Alstyne.

While the assessed value has grown slightly in the other three towns served by the school district, there has been a “real sharp drop” in assessed value in Guilderland, Van Alstyne said.

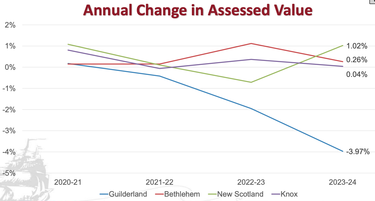

He displayed a graph showing assessed values in the four towns since 2020. New Scotland had the most marked increase at 1.02 percent while the increases for Knox and Bethlehem were under 1 percent.

Guilderland, however, experienced a decrease — of nearly 4 percent in assessed value.

On Aug. 17, Van Alstyne told The Enterprise that, once the error was discovered and adjustments made, assessed value in Guilderland had still decreased but not to the extreme initially portrayed.

Since Guilderland has a smaller portion of value, the other towns have to pay a larger share of the overall levy.

For Bethlehem and New Scotland, the increase in taxable valuation is offset by the share of the tax levy, which results in a significant tax rate increase, the initial analysis said.

For Knox, the tax-rate increase is smaller because the small increase in taxable valuation is offset by the increase in full valuation and share of the tax levy.

The final chart Van Alstyne displayed before the school board voted to adopt the tax warrant showed the annual tax-rate changes over five years. In 2019-20, the year Guilderland did town-wide property revaluation, the levy dropped over 27 percent for town residents living in the school district. But at the same time, of course, many properties had higher values so tax bills may not have been lower.

The next year, it was up about 2 percent from there, followed by 1.5 percent, then about 5 percent, and finally about 6 percent for the 2023-24 school year — with the final number to be adjusted next week to around the 3-percent range.

Summer learning ends as school year starts

Superintendent Marie Wiles told the board that 106 Guilderland students were enrolled this summer in a regional summer-school program held at Schenectady High School, which ended on Aug. 15. Regents exams, which more students will take, were scheduled for Aug. 16 and 17.

Students with disabilities ended their extended school year with a program, held at Guilderland Elementary School, that ended on Friday, Aug. 19.

Students learning English as a new language attended a program at Westmere Elementary this summer, and middle-school students volunteered at the Farnsworth Butterfly Station.

“I just want to thank the faculty and staff who worked so hard this summer on these programs,” said Wiles, “and I hope they now get to enjoy a little bit of summer vacation.”

The first day of classes districtwide for the new school year is Thursday, Sept. 7, but staff return on Sept. 5.

Also, kindergartners are being welcomed ahead at each of the district’s five elementary schools to drop off supplies; the middle school has an orientation for incoming sixth-graders on Wednesday morning, Sept.6; and the high school will also host an orientation session on that day for incoming ninth-graders as well as all new students.

Other business

In other business at its Aug. 15 meeting, the school board:

— Recognized Monaco, Cooper, Lamme & Carr for its $5,000 donation for a varsity softball field scoreboard; the Guilderland law firm’s name will be displayed across the base of the scoreboard. The varsity softball booster club donated the additional $1,833 of the cost;

— Agreed to continue to retain Girvin & Ferlazzo as the district’s lawyers with services billed at an attorney hourly rate of $195 and paralegals at $85 an hour except for litigation and hearings for which the hourly rate for attorneys is $215 and for paralegals is $85;

— Approved an agreement with four other school districts to support an ice-hockey team;

— Approved an agreement to use St. Madeleine Sophie School, Guilderland Town Hall, and the Westmere firehouse for emergency shelter;

— Approved private transportation contracts and awarded, to low bidders, contracts for buying paper towels and toilet tissue;

— Kept school meal prices the same as last year: At the five elementary schools, breakfast will cost $1.95 and lunch will cost $3.00 while at the middle and high schools, breakfast will cost $2.50 and lunch, $3.25;

— Agreed to rent eight classrooms to the Capital Region BOCES for the 2023-24 school year along with ancillary services: two rooms each at Pine Bush Elementary, Westmere Elementary; Farnsworth Middle School, and Guilderland High School. Each classroom rents for $12,000 for a total of $96 while the ancillary services total $157,000;

— Declared a long list of electronic equipment to be “obsolete/surplus.” Van Alstne said, “We have a quote for sale of obsolete iMacs to a company that would erase them and take parts”;

— Approved an agreement with the Capital District YMCA for Universal Pre-K services at Saint Madeleine Sophie Church for the 2023-24 school year;

— Approved the 2023-24 Project S.A.V.E. plan. The state-required plan, which had been posted to the district’s website since the last board meeting, stands for Schools Against Violence in Education;

— Authorized Wiles “to enter into a stipulation of settlement on [the board’s] behalf to resolve all claims in a matter involving student #76994 on the terms and conditions reviewed by the Board of Education in executive session”; and

— Agreed to the dissolution of the District Office Confidential Personnel bargaining unit, which had sought the dissolution.

“The unit will be addressed as individual employees for future terms and conditions of employment,” said the board’s resolution.