July is followed by December

It is easy to live in the moment. Planning for the future can be arduous.

This is especially true for politicians. Elected officials, even on the local level, like to offer quick rewards for voters.

We could see this in the town of Berne when tax rates were set last year. Elected town board members before a hotly contested election two years earlier came up with the scheme of lowering taxes dramatically.

For two years, Berne residents paid under a dollar per $1,000 of assessed valuation.

The Republican board’s Democratic predecessors in Berne had, though several decades, built up a massive fund balance, or rainy-day account, which the GOP board drew down, to the point where the town was late paying for such basics as electricity and is currently late paying bills for accounting and payroll software.

When the funds were gone and government services still needed to be provided, the Republican board reset taxes to where they should have been all along — between four and five dollars of assessed valuation.

The jolt of a tax hike of more than 700 percent was unnecessary.

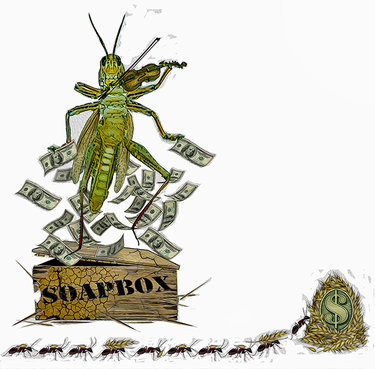

Even children know Aesop’s fable about the grasshopper and the ant. The grasshopper, of course, spends his summer singing and dancing while the ant instead works hard to store up food.

When winter comes, the grasshopper is dying of hunger while the uncharitable ant rebukes him for his idleness.

We thought of this timeless tale when we read about Westerlo’s plan for reserve funds in this week’s story by our Hilltown reporter, Noah Zweifel.

While all three of the school districts we cover — Berne-Knox-Westerlo, Guilderland, and Voorheesville — have sensible plans to set aside reserves and frequently inform the public about them and about their unappropriated fund balances, this is not true of all of the towns and villages we cover.

The schools are strictly limited to no more than 4 percent of their next year’s budget being in a rainy-day account while the towns and villages have no such requirements from the state.

Also, our school leaders must convince voters to pass their budgets, which make up the lion’s share of local property taxes, while the towns and villages are not directly responsible to voters in the same way. Taxpayers vote for the politicians who adopt the municipal budgets but they don’t vote the budgets up or down.

Still, our municipalities are spending taxpayer funds and would be wise to do what Westerlo has done.

Under the leadership of Republican Supervisor Matthew Kryzak, the Westerlo Town Board unanimously voted this month to establish a $1.2 million capital reserve fund, which will be used on various improvements in the town over the next four years.

While the plan has yet to be adopted, the outline provides a clear and responsible guideline for meeting town needs over the next several years.

Kryzak’s plan allocates the money to 18 separate projects, most related to building improvements. However, nearly half of the fund would go toward just two items: a new plow for the highway department, at $350,000; and a renovation of the transfer station, for $225,000.

Looking toward the far future, Kryzak surmises that, once the Rapp Road landfill is closed, scheduled for 2028, the town won’t “get those bargain-basement tipping fees that we’ve all been spoiled by” with the landfill “right down the road.”

With the proposed renovations to the Westerlo transfer station, Kryzak said, “We’re kind of training people now to help save on that in the future.”

After a bruising election in November, Kryzak said he plans to leave his post once his plan is in place and his term is up. Being supervisor, the businessman said, is “not an enjoyable job.” He has taken on the task, he said, “because I want to see things done right.”

We hope other municipalities follow suit.

The last time we remember a Hilltown having a long-time strategy to save for the future was when Knox built its expanded town hall in 2007. Town leaders knew that the hall built in 1977 was too small to fit Knox’s future needs and wasn’t accessible to people with handicaps.

They saved for years and had an architect draw up a million-dollar expansion plan accessible to all while, at the same time, like the ant, town leaders set aside funds for the project every year, largely under the leadership of Democratic Supervisor Michael Hammond.

The expanded hall has judge’s chambers, a much larger meeting space for the board, office spaces, a large lower level for public events, and a fireproof storage area for town records.

Just this past weekend, for Knox’s Winterfest, kids listened to stories and did crafts in the downstairs community room while, in the upstairs meeting room, Professor Gary Kleppel, who chairs the town’s agricultural council, talked about farming.

The long-term savings paid off; the building has stood Knox in good stead.

Kryzak said he hopes Westerlo can one day build new public buildings.

“The buildings are very important because they’re owned by the taxpayer, and I want the taxpayers to own an asset, not a liability,” he said, explaining that new buildings should be planned thoughtfully, so that they can continue to meet needs and standards for “not 5 years, not 50 years … but 100 years.”

This is Kryzak’s favorite saying: “Buy once, cry once.”

In the meantime, Westerlo has a plan for reserve funds in the shorter term that will make for a smooth running of government.

Kryzak said that he often reaches out to the comptroller’s office for guidance on structuring the accounts so that “everybody understands we’re not just saving for a rainy day, we’re saving for specific items that need to be replaced, repaired, updated, things of that nature,” while ensuring enough is left over for sudden emergencies.

The state comptroller’s office has a Local Government Management Guide for reserve funds that anyone can access; we urge our municipal leaders to do so.

“Reserve funds provide a mechanism for legally saving money to finance all or part of future infrastructure, equipment and other requirements,” the guide says. “Reserve funds can also provide a degree of financial stability by reducing reliance on indebtedness to finance capital projects and acquisitions.”

The guide stresses that reserve funds are useful in good times and bad.

When the economy is uncertain, the funds lessen the need to cut services or raise taxes.

In good times, money that isn’t immediately needed can be set aside for future use.

While the guide focuses on reserve funds, it also notes, “A reasonable level of unrestricted, unappropriated fund balance provides a cushion for unforeseen expenditures or revenue shortfalls and helps to ensure that adequate cash flow is available to meet the cost of operations.”

Kryzak said that having reserve funds set up will show the state comptroller that Westerlo isn’t simply hoarding the massive $2.4 million fund balance that he helped build up as supervisor.

Setting up reserve funds is “prudent management” the guide asserts. “Saving for future capital needs can reduce or eliminate interest and other costs associated with debt issuances,” it explains.

Reserve funds can be used to help protect the budget against known risks like a potential lawsuit or unknown risks like a major ice storm, the guide notes while stressing such funds should not be used as “a parking lot” for excess cash.

Rather, a clear purpose should be defined for each reserve as Westerlo has outlined.

The 42-page guide goes on to describe the process for setting up the many different types of reserves authorized by General Municipal Law, ranging from capital and repair reserves to solid-waste management facility reserves.

The guide also explains board direction and oversight of reserve funds and stresses, “Any governing board that is planning to establish and finance reserve funds on a regular basis should develop a written policy that communicates to taxpayers why the money is being set aside, the board’s financial objectives for the reserves, optimal funding levels, and conditions under which the assets will be utilized.”

Such clarity is essential since the town’s money is, after all, from the taxpayers.

Boards also need to regularly assess the reasonableness of the amounts accumulated in their reserves and reduce or add to them according to need.

The message from the state comptroller’s office is similar to that of Aesop’s fable.

“Planning today and saving incrementally for expected future events can help mitigate the financial impact of major, nonrecurring or unforeseen expenditures on your annual operating budget,” the office says. “Establishing and funding allowable reserve funds for a clear purpose can help smooth out spikes in the annual budget and in the real property tax levy.”

Kryzak called it common sense. ““If you want to make things better, the money has to come from somewhere …,” he said. “Anybody who’s financially healthy and financially savvy knows you don’t just wake up and say, ‘I’m going to do this — I don’t have the resources but I’ll do it anyway. Everyone knows in order to be successful you need to have a plan and work to that plan.”

Everyone, that is, but the grasshopper or perhaps the sunshine politician.